- Cryptocurrency market outlook april 2025

- Latest cryptocurrency news april 2025

- Cryptocurrency news april 28 2025

Cryptocurrency market news april 2025

Tether’s long-standing market dominance will drop below 50%, challenged by yielding alternatives like Blackrock’s BUIDL, Ethena’s USDe, and even USDC Rewards paid by Coinbase/Circle https://comic-play-online.com/. As Tether internalizes yield revenue from USDT reserves to fund portfolio investments, marketing spend by stablecoin issuers/protocols to pass-through revenue will convert existing users away from Tether and onboard new users to their yield-bearing solutions. USDC rewards paid on users’ Coinbase Exchange and Wallet balances will be a powerful hook that will boost the entire DeFi sector and may be integrated by fintechs to enable new business models. In response, Tether will begin to pass through revenue from collateral holdings to USDT holders and may even offer a new competitive yielding product like a delta-neutral stablecoin. -Charles Yu

BTC chart analysis for 2025 – The longest term Bitcoin price chart shows that BTC is finally clearing $100k. BTC is now consolidating around the median of its very long term rising channel. The probability that our BTC forecasted prices, both support and bullish targets, will be hit in 2025 is very high.

The ongoing development of AI-powered DeFi applications, on-chain AI agents, and predictive trading models suggests that AI-related tokens could see renewed interest in February, particularly as open-source AI advancements continue to accelerate.

Cryptocurrency Market Analysis February 2025: The cryptocurrency market has always been a dynamic and unpredictable landscape, but February 2025 has emerged as a pivotal month for investors, traders, and blockchain enthusiasts. With regulatory clarity advancing, institutional adoption surging, and technological innovations reshaping the ecosystem, this analysis dives deep into the trends, price movements, and forecasts that defined the crypto market in February 2025. Whether you’re a seasoned investor or a curious observer, this breakdown will equip you with actionable insights.

Cryptocurrency market outlook april 2025

The U.S. spot Bitcoin ETPs will collectively cross $250bn AUM in 2025. In 2024, the Bitcoin ETPs collectively took in more than $36bn in net inflows, making them the best ETP launch as a cohort in history. Many of the world’s major hedge funds bought the Bitcoin ETPs, including Millennium, Tudor, and D.E. Shaw, while the State of Wisconsin Investment Board (SWIB) bought a position, according to 13F filings. After just 1 year, the Bitcoin ETPs are only 19% away ($24bn) from flipping the AUM of all the U.S. physical gold ETPs. -Alex Thorn

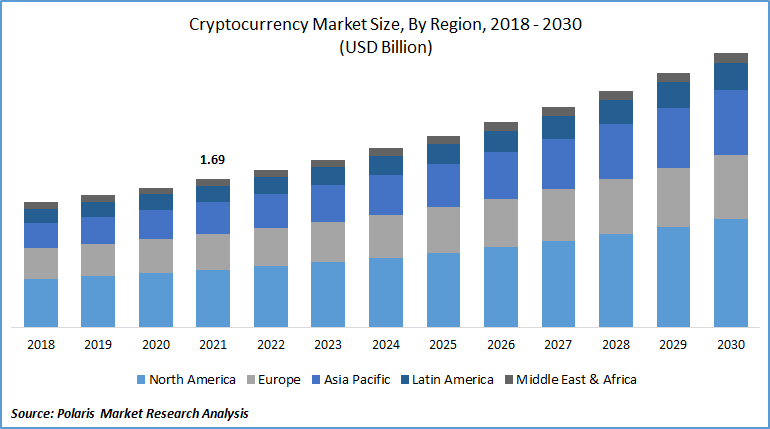

In summary, April 2025 is a pivotal month for the cryptocurrency market, teeming with innovation and regulatory progress. With shifts in market dynamics, the rise of key technological advancements, and the adoption of enhanced security measures, the industry is poised for growth. Despite inherent volatility, cryptocurrency continues to attract institutional and individual investors seeking diverse financial opportunities. By harnessing blockchain’s potential, future trends suggest an evolving digital economy, deeply intertwined with technological innovation. As the year progresses, cryptocurrencies’ impact on global finance will undoubtedly offer both lessons and lucrative prospects.

Five Nasdaq 100 companies and five nation states will announce they have added Bitcoin to their balance sheets or sovereign wealth funds. Whether for strategic, portfolio diversification, or trade settlement reasons, Bitcoin will begin finding a home on the balance sheets of major corporate and sovereign allocators. Competition among nation-states, particularly unaligned nations, those with large sovereign wealth funds, or even those adversarial to the United States, will drive the adoption of strategies to mine or otherwise acquire Bitcoin. -Jianing Wu

Leverage and liquidation risk: The current leverage ratio in the cryptocurrency market is relatively high (perpetual contract funding rates have recently rebounded), if CPI data triggers violent price fluctuations, it may trigger large-scale liquidations. For example, after the February CPI data was released, Bitcoin’s trading volume surged 40% within 1 hour, with obvious panic selling. Additionally, tariff policy and inflation transmission: The automobile import tariffs (25%) implemented by the Trump administration on April 2 may push up US import costs, exacerbating imported inflation pressure. If March CPI data exceeds expectations as a result, the market may further worry about Fed policy tightening, putting pressure on crypto assets.

The analysts at VanEck, Matthew Sigel (Head of Digital Asset Research) and Patrick Bush (Senior Investment Analyst), have just published their 10 predictions for the cryptocurrency market in 2025. Here’s a summary:

Latest cryptocurrency news april 2025

In summary, April 5, 2025, showcases an evolving cryptocurrency landscape characterized by notable increases in major cryptocurrencies like Bitcoin and Ethereum. The excitement in altcoins like Cardano and Solana adds another layer to the investment decisions facing individuals. Investors should navigate their choices based on rigorous research and market sentiment. A careful assessment of whether to buy or hold based on the current price trends could aid in enhancing investment outcomes in this volatile market.

Given the current marketplace, the question arises: should investors buy or hold? Those who lean towards short-term trading might find the recent price surges in Bitcoin and select altcoins encouraging for immediate investment opportunities. However, long-term holders may want to observe further market developments before making additional purchases. Analyzing factors such as regulatory news, technological advancements, and global economic conditions could provide insights into future price movements and help determine whether to buy more at this juncture or maintain existing holdings.

We believe the crypto bull market will persist until 2025, reaching its first peak in the first quarter. At the cycle’s peak, we project Bitcoin (BTC) to be valued at approximately $180,000, and Ethereum (ETH) to trade above $6,000.

Looking back at the past months, Bitcoin and Ethereum have exhibited resilience even amid fluctuating macroeconomic conditions. In March 2025, Bitcoin reached a low of $65,000, demonstrating its ability to recover quickly. Ethereum followed a similar trajectory, dipping to $4,500 before rebounding. Such historical price data aids potential investors in understanding the volatility inherent to cryptocurrencies. Observers note that sustained support levels for Bitcoin appear to be around $70,000, while Ethereum has found psychological support near the $4,800 mark. These statistics are important for those considering buying or holding these assets during this prediction period.

In summary, April 5, 2025, showcases an evolving cryptocurrency landscape characterized by notable increases in major cryptocurrencies like Bitcoin and Ethereum. The excitement in altcoins like Cardano and Solana adds another layer to the investment decisions facing individuals. Investors should navigate their choices based on rigorous research and market sentiment. A careful assessment of whether to buy or hold based on the current price trends could aid in enhancing investment outcomes in this volatile market.

Given the current marketplace, the question arises: should investors buy or hold? Those who lean towards short-term trading might find the recent price surges in Bitcoin and select altcoins encouraging for immediate investment opportunities. However, long-term holders may want to observe further market developments before making additional purchases. Analyzing factors such as regulatory news, technological advancements, and global economic conditions could provide insights into future price movements and help determine whether to buy more at this juncture or maintain existing holdings.

Cryptocurrency news april 28 2025

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

🚀 Popping #CryptoNews past week: 🔹Web3 platform Travala integrates crypto payments for 2.2M hotels on Trivago. 🔹Maryland Plans To Establish Strategic Bitcoin Reserve. 🔹Hong Kong Telecom Launches Blockchain-Based Marketing Platform. 🔹Czech Republic Exempts Bitcoin From

Looking ahead to this week, PMI data for the U.S. services sector is awaited, with Wednesday’s FOMC interest rate decision and Powell’s guidance seen as critical for the markets. In the UK, expectations for a rate cut are rising, while U.S. jobless claims will test the strength of the labor market. In the crypto market, the appointment of SEC’s new chair Paul Atkins and his favorable stance toward digital assets drew attention. ETF applications from major institutions like Bitwise, BlackRock, Nasdaq, and 21Shares signal growing institutional interest. Developments such as Mastercard’s stablecoin integration and the closure of PayPal’s PYUSD investigation indicate accelerating integration between crypto and traditional finance. Meanwhile, MicroStrategy’s purchase of 15,355 BTC, bringing its total holdings to 553,555 BTC, supported market confidence.

CFDs and other derivatives are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how an investment works and whether you can afford to take the high risk of losing your money.

The overall market picture remains tilted towards bullish trends for the euro, gold, and bitcoin, although the coming days may bring corrective movements as part of broader upward structures. Key resistance and support levels will play a decisive role in determining whether the corrections are short-lived or signal a deeper reversal. Traders should remain alert to breakouts of major technical boundaries, which will offer clearer signals for the further development of trends during the week from April 28 to May 2, 2025.